Introduction

NeuralStockPredictor is a project that introduces neural networks and illustrates an example of how one can use neural networks to predict stock prices. It is built with the goal of allowing beginners to understand the fundamentals of how neural network models are built and go through the entire workflow of machine learning. This model is in no way sophisticated, so do improve upon this base project in any way.

The core steps involved is: download stock price data from Yahoo Finance, preprocess the dataframes according to specifications for neural network libraries and finally train the neural network model and backtest over historical data.

This model is not meant to be used to live trade stocks with. However, with further extensions, this model can definitely be used to support your trading strategies.

I hope you find this project useful in your journey as a trader or a machine learning engineer. Personally, this is my major deep learning project, so I’ll appreciate if you give it a clap.

As a disclaimer, this is a purely educational project. Any backtested results do not guarantee performance in live trading. Do live trading at your own risk. This guide has been cross-posted in my GitHub, NeuralStockPredictor

Overview

The overall workflow for this project is as such:

1- Acquire the stock price data — this will give us our features for the model.

2- Preprocess the data — make the train and test datasets.

3- Use the neural network to learn from the training data.

4- Backtest the model across a date range.

5- Make useful stock price predictions.

6- Supplement your trading strategies with the predictions.

Although this is very general, it is essentially what you need to build your own machine learning or neural network model.

Getting Started For those of you that do not want to learn about the construction of the model (although I highly suggest you to), clone and download the project, unzip it to your preferred folder and run the following code in your computer.

pip install -r requirements.txt

python LSTM_model.py

It’s as simple as that! Now your neural network will be trained and ready to make predictions about the stock price (remember to backtest if you are going to use the predictions).

Requirements

For those who want a more details manual, this program is built in Python 3.12. If you are using an earlier version of Python, like Python 2.x, you will run into problems with syntax when it comes to f strings. I do suggest that you update to Python 3.x, if you want to appreciate the elegance of this program.

pip install -r requirements.txt

Stock Price Data

Now we come to the most dreaded part of any machine learning project: data acquisiton and data preprocessing. As tedious and hard as it might be, it is vital to have high quality data to feed into your model. As the saying goes “Garbage in. Garbage out.” This is most applicable to machine learning models, as your model is only as good as the data it is fed. Processing the data comes in two parts: downloading the data, and forming our datasets for the model. Thanks to Yahoo Finance API, downloading the stock price data is relatively simple (sadly I doubt not for long).

To download the stock price data, we use pandas_datareader which after a while did not work. So we use this yfinance.

Preparing Train Dataset

The goal for our training dataset is to have rows of a given length (the number of prices used to predict) along with the correct prediction to evaluate our model against. I have given the user the option of choosing how much of the stock price data you want to use for your training data when calling the Preprocessing class. Generating the training data is done quite simply using numpy.arrays and a for loop. You can perform this by running:

preprocessing.get_train(seq_len)

Preparing Test Dataset

The test dataset is prepared in precisely the same way as the training dataset, just that the length of the data is different. This is done with the following code:

preprocessing.get_test(seq_len)

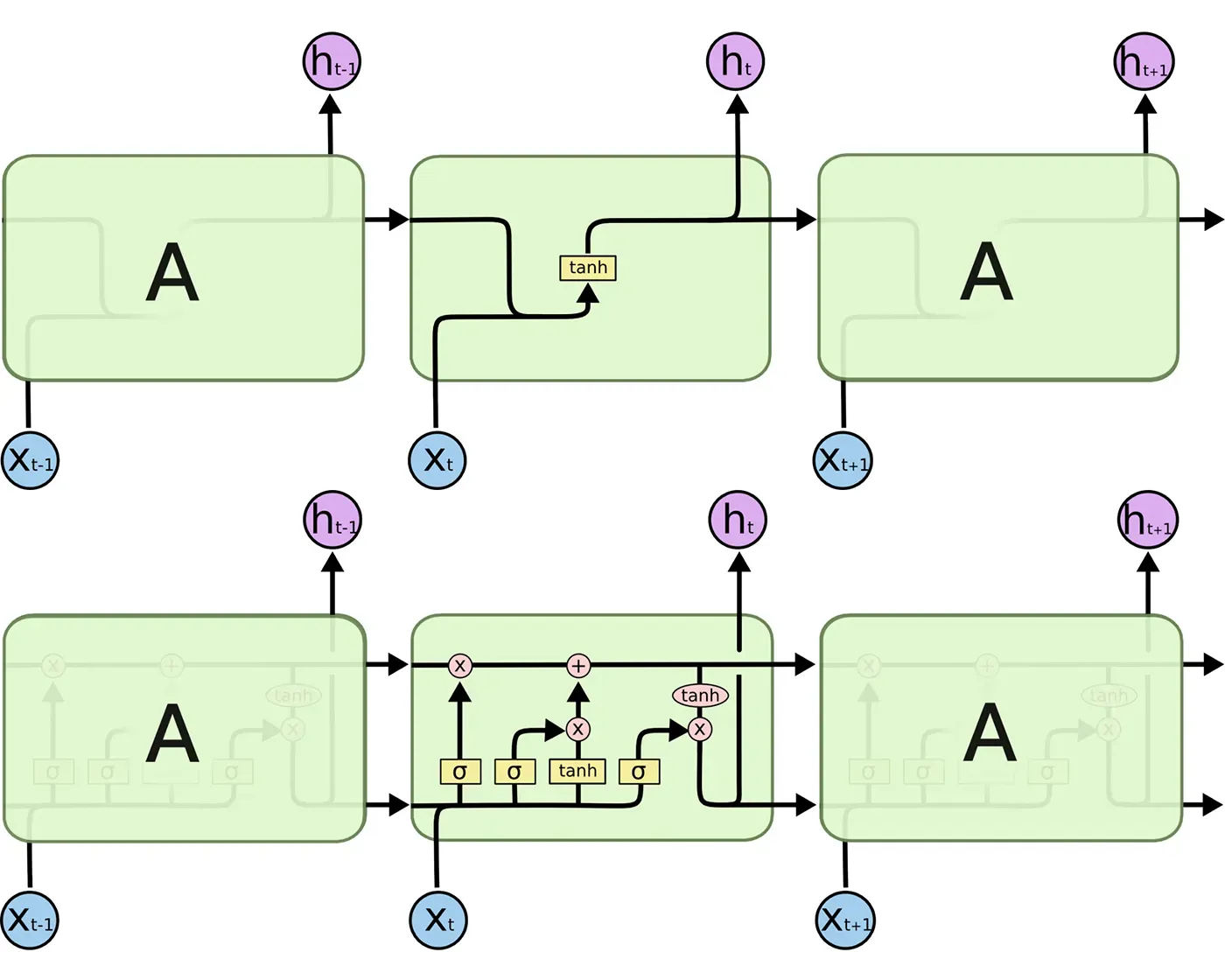

MLP vs LSTM models

MLP vs LSTM (model-architecture)

Multilayer Perceptron Model

A multilayer perceptron is the most basic of neural networks that uses backpropagation to learn from the training dataset. If you want more details about how the multilayer perceptron works, do read this blog.

LSTM Model

The benefit of using a Long Short Term Memory neural network is that there is an extra element of long term memory, where the neural network has data about the data in prior layers as a ‘memory’ which allows the model to find the relationships between the data itself and between the data and output. Again for more details, please read this article.

A schematic for LSTM neural networks

Backtesting

My backtest system is simple in the sense that it only evaluates how well the model predicts the stock price. It does not actually consider how to trade based on these predictions (that is the topic of developing trading strategies using this model). To run just the backtesting, you will need to run

back_test(strategy, seq_len, ticker, start_date, end_date, dim)

The dim variable is the dimensions of the data set you want and it is necessary to successfully train the models.

Stock Predictions

Now that your model has been trained and backtested, we can use it to make stock price predictions. In order to make stock price predictions, you need to download the current data and use the predict method of keras module. Run the following code after training and backtesting the model:

data = pdr.get_data_yahoo("NVDA", "2020-12-19", "2024-07-03")

stock = data["Adj Close"]

X_predict = np.array(stock).reshape((1, 10)) / 200

print(model.predict(X_predict)*200)

Extensions

As mentioned before, this projected is highly extendable, and here some ideas for improving the project.

Getting Data

Getting data is pretty standard using Yahoo Finance. However, you may want to look into clustering data in terms of trends of stocks (maybe by sector, or if you want to be really precise, use k-means clustering?).

Neural Network Model

This neural network can be improved in many ways:

Tuning hyperparameters:find the optimal hyperparameters that gives the best predictionBacktesting:Make the backtesting system more robust (I have left certain important aspects out for you to figure). Maybe include buying and shorting?Try different Neural Networks:There are plenty of options and see which works best for your stocks.

Supporting Trade

As I said earlier, this model can be used to support trading by using this prediction in your trading strategy. Examples include:

- Simple long short strategy: you buy if the prediction is higher, and vice versa

- Intraday Trading: if you can get your hands on minute data or even tick data, you can use this predictor to trade.

- Statistical Arbitrage: use can also use the predictions of various stock prices to find the correlation between stocks.

Have a Wonderful day. <Cheers!>